Discover How You Could...

Discover How You Could...

Build Wealth & Achieve Financial Freedom Faster

Without A Business Or Day Trading!

We show busy, everyday people, how to prosper in the 'new era of finance' by being their own hedge fund manager.*

Free on-demand training

Free on-demand training

Click Here To Play Video

AS ADVERTISED ON

AS ADVERTISED ON

(Click A Logo Above To Read The Article)

(Click A Logo Above To Read The Article)

"This is SO MUCH SAFER!"

The potential with this entire space [DeFi] is HUGE but you need to learn from the professionals who will show you how to minimize or take away the risks. This community has published amazing content and coaching to help you win.

– John Lee Dumas

– John Lee Dumas

What Members Are Saying*

What Members Are Saying*

"If you ignore the news you find out quickly this is the real deal. I'm making better returns here than other investments I have."

– Andrew Leone

"The only funds I had were sitting in Bitcoin. I didn't even know this was out there. Coaching with Dan and his community has been amazing."

– Jason Duprat

"I love how methodically simple the program is laid out for someone like me who never did anything like this before."

– Lionel Le Kouby

"I had two criteria when I joined. One was education, and the program has already far exceeded expectations. The second was coaching. What I underestimated was how valuable the community would be."

– Melissa Blevins

"I love the live coaching calls. I've never seen a program deliver that kind of value literally in real-time. For me the coaching calls have been amazing and I'd encourage anyone coming into the program to make sure they take advantage of them."

– Will Schuster

"Before this program I did not have the courage to invest in crypto. Now that I have gone through the course I am excited about the future of crypto and look forward to the opportunity. I'm excited to be here!"

– Joji Lue

"If you ignore the news you find out quickly this is the real deal. I'm making better returns here than other investments I have."

– Andrew Leone

"The only funds I had were sitting in Bitcoin. I didn't even know this was out there. Coaching with Dan and his community has been amazing."

"I love how methodically simple the program is laid out for someone like me who never did anything like this before."

– Lionel Le Kouby

"I had two criteria when I joined. One was education, and the program has already far exceeded expectations. The second was coaching. What I underestimated was how valuable the community would be."

– Melissa Blevins

"I love the live coaching calls. I've never seen a program deliver that kind of value literally in real-time. For me the coaching calls have been amazing and I'd encourage anyone coming into the program to make sure they take advantage of them."

– Will Schuster

"Before this program I did not have the courage to invest in crypto. Now that I have gone through the course I am excited about the future of crypto and look forward to the opportunity. I'm excited to be here!"

– Joji Lue

*Individual's experiences may not be typical. background, education, and effort may effect your experience. your results may vary. featured Members above were offered BONUS coaching in exchange for their authentic testimonial.

Our Process

Education & Execution Frameworks

Our "on-demand" course material teaches simple concepts in combination with "over the shoulder" training so you can follow along and implement quickly. Most students complete their initial training in 4 weeks part time. We teach you to use tools that make DeFi simple (especially for the "non techie" person). We provide our members "Done For You" curated portfolio templates you can use instantly!

Access, Coaching, & Support

- Weekly Coaching Calls & Hot Seats

-

Access Unlimited Expertise & Guidance

-

24/7 Member Concierge

You can attend group coaching calls & more personalized hot seats. These are live rooms, with regular access to coaching, so anyone needing help has a place to get unstuck. Our members are never on their own. The entire program experience, from the course material to coaching calls, is accessed through a proprietary member portal. Coaches, or Member Experts are always around!

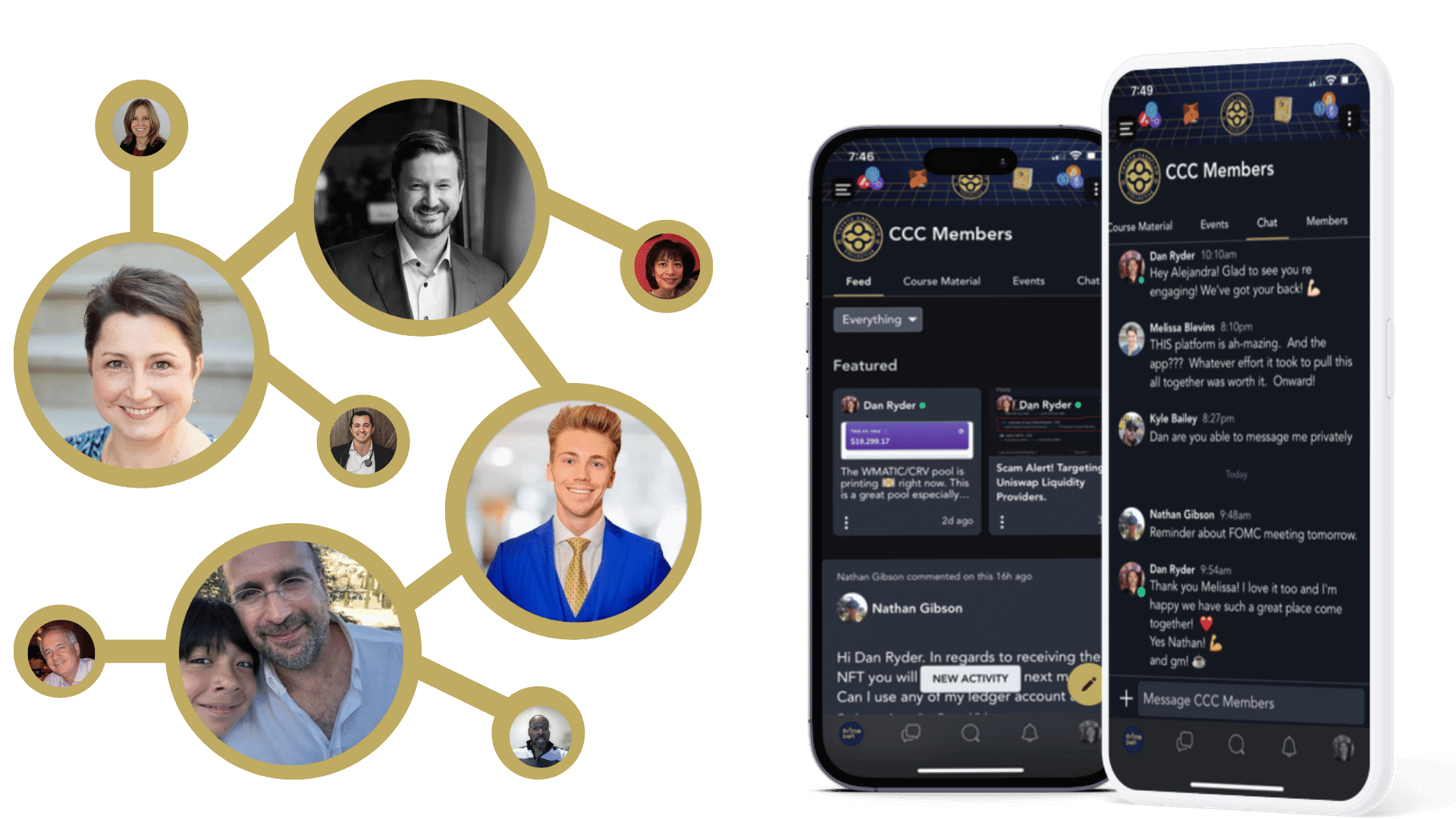

A Wealth Focused Community

- Founders Community, Web + Mobile App

-

Wealth Connections Via Our Network Experts

-

Wealth Boosting Networking & Collaboration

We have a robust members area where you can connect, message, and work with each other. Our mobile apps are available on both iOS & Android so you can take this community "on the go". Get access to our high value members' worldwide networks. Get to know other members, share ideas, & collaborate. All you have to do is show up. Remember, your net worth is a reflection of your network!

Member Reviews*

Member Reviews*

*Individual's experiences may not be typical. background, education, and effort may effect your experience. your results may vary. FEATURED MEMBERS ABOVE WERE OFFERED BONUS COACHING IN EXCHANGE FOR THEIR AUTHENTIC TESTIMONIAL.

Frequently Asked Questions

"Is This Safe? What Are The Risks?"

All opportunities come with risk and this one is no different. The question is how can you mitigate or avoid the risks with a particular opportunity? The biggest risk in DeFi is a "smart contract breach" which is essentially a "digital bank robbery". We earn yield by acting as crypto lenders so if there is a theft incident, tokens could be lost. In traditional finance we are used to having FDIC insurance which protects our deposits. In DeFi there is no FDIC insurance because you are your own custodian. However, you can purchase your own DeFi cover privately, and similarly protect your funds in the unlikely event of a breach. In addition to using cover products, we vet opportunities heavily and only work with reputable DeFi applications.

"Isn't This Staking? How Is This Different?"

DeFi is very different from common staking platforms people may have heard of like Celsius or BlockFi, or even bigger exchanges like Kraken and Coinbase that offer basic staking services. All of those companies are corporate entities that operate as custodians by holding customer funds. With DeFi, YOU are your own custodian. All of the negative stories people may have heard about in the news reporting on people losing funds were largely tied to exchanges collapsing (FTX) or bankruptcies (Celsius, BlockFi) of big centralized entities that acted irresponsibly with customer funds. In DeFi you control your funds and participate in decentralized yield opportunities that take place on the actual blockchain through the power of smart contracts. The biggest story nobody heard was that despite all of the windfall in the centrally managed crypto markets, DeFi never skipped a beat. Knowledgeable DeFi participants have been earning risk-mitigated yields the entire time using strategies that are not possible with "centralized" staking.

"How Soon Can I See Results & Are They Market Dependent?"

Once someone has onboarded from fiat to crypto with a self custody vault, they can begin participating in yield and cash flow opportunities as soon as possible. Funds deployed immediately begin earning yield in most cases. Investors can choose to hedge against market volatility which may result in lower returns. Self managed DeFi portfolios have historically had the opportunity to match or in some cases outperform hedge fund managers in traditional finance! All of that being said, yield earned and other DeFi reward opportunities are investment opportunities, and any investment comes with the risk of loss. We use sound risk management to protect yield/rewards earned as much as possible, but no one is immune to potential risks.

"Will I Need To Pay Taxes On The Rewards I Earn?"

Tax liability would be best determined by a tax professional. Prime DeFi does not offer tax advice or financial advice of any kind. Every circumstance is different and a licensed tax professional would be the best person to consult with on this matter. Depending on your circumstances you could have capital gains tax, income tax, or potentially even no tax liability. There are third party apps like Koinly.io to provide tax professionals with the information they need to help individuals determine any tax liability.

"What About Regulation? Isn't The SEC Suing Exchanges?"

The regulatory climate for the crypto industry has become quite favorable recently both in the United States and the European Union. The SEC (Securities and Exchange Commission) has been overruled by judges in recent unfair cases against good businesses offering custodial and trading services like Coinbase. We have a crypto friendly majority in virtually every branch of government after recent elections who are pushing forward final drafts of future law as well as the President's commitment to develop a national strategic crypto reserve. All of this is very exciting for crypto however it's important to note that regulation is centered around corporate businesses acting as custodians. In DeFi we are our own custodians. We participate in "self custody" opportunities to earn rewards with liquidity we wholly own and control on decentralized markets. Think of it like the wallet and cash in your pocket. There is no regulation for the wallet in your pocket. Having said that, all of the positive momentum for crypto regulation is inviting very large market participants which could drastically increase the demand for DeFi opportunities beyond what we are already seeing today!

"Is It Possible To Get 1:1 Support And Coaching?"

Yes! Prime DeFi "Collective" members get access to new member onboarding calls as well as weekly live group coaching sessions with DeFi experts. You’ll get a chance to ask your specific questions in the same manner as 1:1, but you’ll have a group of other trusted members there as well who can provide additional feedback and support. Club Xcelerator ("ClubX") members also get access to our “Hot Seat” calls where they can rotate into private 1:1 virtual sessions with coaches, and group experts. These sessions offer fast and effective feedback so you can independently manage your own portfolio.

Ready To Get Started?

Discover How You Can Join The #1 Values-Driven Coaching Community In The World Focused On One Goal...

To Prepare YOU To Prosper With DeFi! Will You Be Our Next Success Story?

© 2025 Ryder Media Inc.

All Rights Reserved

© 2025 Ryder Media Inc.

All Rights Reserved

Company

Company

151 C. de San Francisco Ste 200

San Juan, PR 00901

151 C. de San Francisco Ste 200

San Juan, PR 00901

Follow us

Follow us

*DISCLAIMER: PrimeDEFI.COM promotes an educational product ONLY. We are not selling investments, insurance, real estate, securities, or anything other than education and are not providing tax advice, legal advice, or investment advisory products. Investing and trading stocks, futures, options, or digital currencies involves a substantial degree of risk and may not be suitable for all investors. Past performance is not necessarily indicative of future results. The information provided is for educational purposes only and is not a recommendation to buy or sell any security. By accessing any content on this site or related sites, you agree to be bound by the terms of service and privacy policy (located in the footer of this website). We discuss general principles and strategies, but we do not know anything about you or your financial circumstances. As you consider applying the educational principles and strategies you see here, you should understand that there is risk in any investment and we cannot guarantee any particular results or success. Earnings and income representations made by Dan Ryder, Ryder Media Inc., and their advertisers/sponsors are aspirational statements only of your earnings potential. These results are not typical and results will vary. The results on this page are OUR results and from our set of experiences. We can in NO way guarantee you will get the exact same or similar results. ALL TESTIMONIALS SHOWN ARE REAL BUT ALSO DO NOT CLAIM TO REPRESENT TYPICAL RESULTS. ANY SUCCESS DEPENDS ON MANY VARIABLES WHICH ARE UNIQUE TO EACH INDIVIDUAL, INCLUDING COMMITMENT AND EFFORT. TESTIMONIAL RESULTS ARE MEANT TO DEMONSTRATE WHAT THE MOST DEDICATED MEMBERS HAVE DONE AND SHOULD NOT BE CONSIDERED AVERAGE BECAUSE THEY ARE NOT AVERAGE. FURTHER, WE MAKE NO GUARANTEE OF ANY FINANCIAL GAIN FROM THE USE OF OUR PRODUCTS.